Reporting Automation

BiCXO’s automated financial reporting software can revolutionaries your MIS report generation workflow. The MIS reporting process can be automated to provide structured reports in minutes, freeing you from manual data entry and tedious formatting tasks. Receive these reports directly to your inbox shortly after each financial period closes, empowering you to focus on strategic financial analysis and informed decision-making.

Read moreConsolidation

Intercompany eliminations, multicurrency transactions, and varying reporting periods can turn consolidation into a cumbersome task. Eliminate the need for manual processes and generate group-level consolidated reports in minutes with just a click of a button. Focus on strategic analysis instead of tedious calculations and data manipulation.

Read moreReconcilation

Manually reconciling transactions can be time-consuming and error-prone while there might be various types of reconciliation that we can address based on the need, BiCXO’s GST reconciliation software allows you find and correct inconsistencies with less effort, assuring the accuracy of your financial reporting and reducing the risk of errors particularly in GST or accounts receivable/payable (AR/AP) saving a lot of time and effort for your company.

Read more

Cashflow Statements

Gain real-time insight into your cash flow. BiCXO’s automated financial reporting software gives you a detailed picture of your cash flow trends, allowing you to recognize potential gaps or surpluses rapidly. Generate cash flow estimates with simplicity, allowing you to prepare ahead of time for future financial demands and guarantee your company has the resources it requires to prosper.

Read moreList of reports for CFOs

- Consolidated P&L across Group Companies

- Consolidated P&L across branches

- Branch Wise P&L

- Division Wise P&L / Cost center wise / Project wise

- Budget vs actual reports with variances

- By segments

- By regions

- By divisions

- By Profit Centers

- By segments/ regions/ divisions

- COGS recon

- Interbranch/ interdivision

- Fx conversion and translation difference report

- Books vs 3B

- 3B vs 2B

- 2B vs Books

- Automated Vendor mails for differences.

- Books vs returns

- invoices not knocked off

- Overdue invoices reports

- Ageing analysis reports

- Customer balance confirmation reports with automated mails to customers

- Our Books vs Customer books recon

- invoices not knocked off

- Overdue invoices reports

- Ageing analysis reports

- Vendor balance confirmation reports with automated mails to customers

- Books vs Vendor Books recon

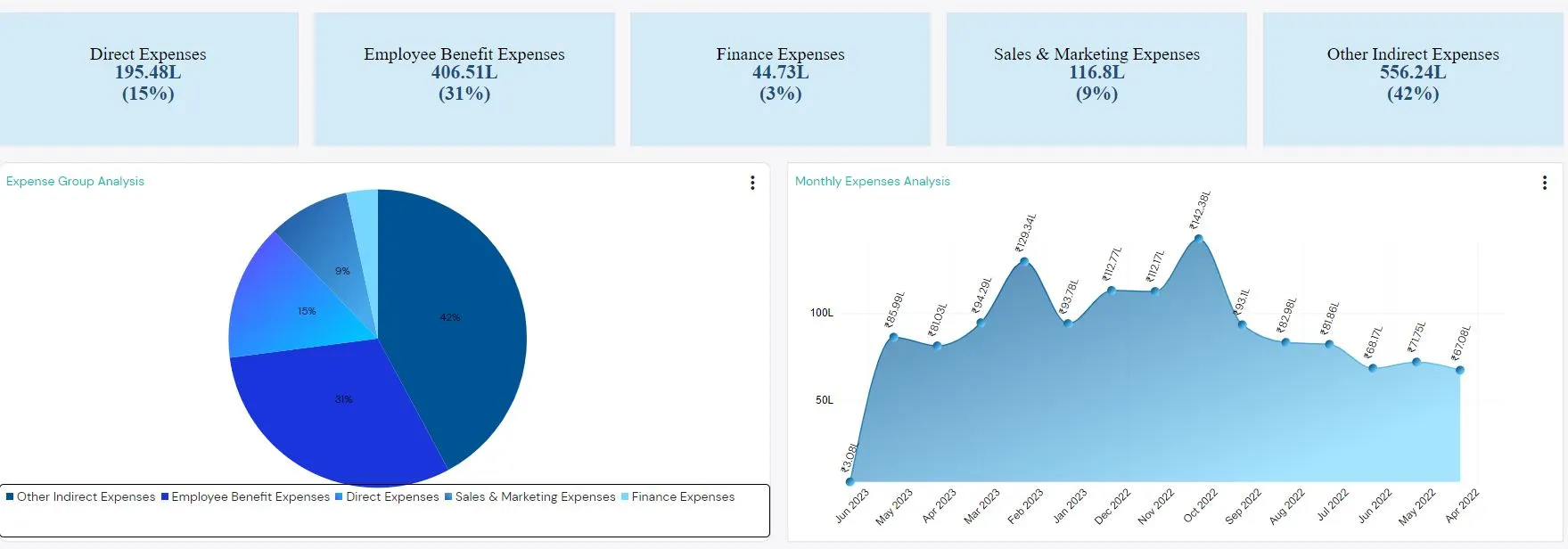

- Month Wise expense trend

- Department wise/ Region wise

- Expense group wise

- Fixed vs Variable

- Books vs payroll records

- Department-wise / division-wise payroll / Cost Center wise

- Company / Division / Cost center

- Cashflow as per Indirect method

Working Capital

Working capital is a cornerstone for the smooth operation of any organization. Efficiently handling working capital empowers a company to navigate cash flow fluctuations, retain command over its financial assets, and steer clear of potential liquidity crises.

Read more

Expense Management

Controlling expenses is a CFO’s key weapon for profitability. BiCXO’s automated financial reporting software provides you with real-time expense insights. Drill down by category and line item to identify trends and budget deviations. Automated notifications from the software detect spending exceptions, allowing you to address potential cost issues and improve your financial health.

Read more

FAQ's

- Data extraction

- Report generation

- Data visualization

- Exception alerts

Data collection: Automatically gathers data from your ERP, spreadsheets, and other sources. Calculations and formatting: Applies formulas and formats reports based on your templates. Scheduling and delivery: Generates reports at scheduled times and delivers them to stakeholders. This eliminates manual work, reduces errors, and ensures timely delivery of accurate financial reports, allowing you to focus on strategic analysis and decision-making.