Treasury Management

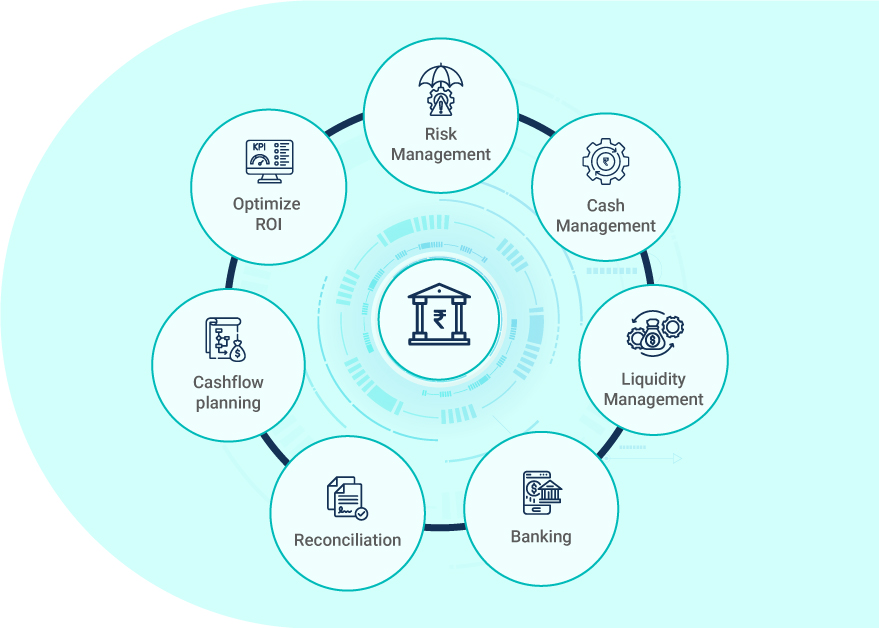

BiCXO Treasury Management module helps organisation in improving cash flows, maintaining strong liquidity position, reduce borrowing costs, improve ROI on surplus funds and mitigate financial risks.

BiCXO enables clear visibility of the current and projected funds position, allows treasury managers to strategize on deployment of funds to reduce external borrowings or increase surplus funds.

Get your operational process streamlined with

Maintaining Bank limits

Bank Reconciliations

Tracking LC’s and BG’s