Managing customer collections can be a challenging task, with various intricacies that demand attention. In this blog, we’ll explore the multi-dimensions of the world of customer collection and differentiate between strategic and tactical approaches. By doing so, we will aim to offer insights that can enhance your accounts receivable management, all while ensuring and enhancing a smooth flow of cash and safeguarding your working capital.

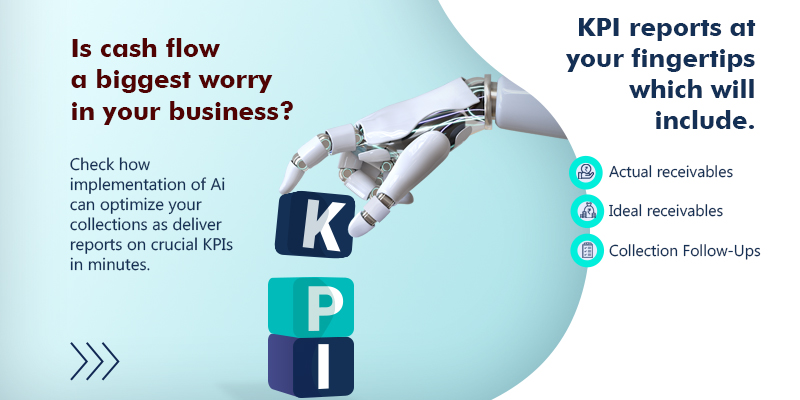

Key Performance Indicators (KPIs)

Establishing clear and measurable KPIs for your collection process. These KPIs serve as crucial benchmarks to gauge the efficiency and effectiveness of your efforts in collecting outstanding payments. Setting the right KPIs ensures that your team has well-defined goals and objectives. These can include metrics such as the average time it takes to collect payments, the percentage of overdue accounts, or the accuracy of invoicing.

However, it’s not enough to merely set these KPIs. Rigorous and consistent monitoring is essential through strategic and tactical initiatives. Regularly tracking and analysing the data against these KPIs helps in identifying trends, bottlenecks, and areas that may need improvement. By doing so, you can adapt your collection strategies and tactics as needed to meet your targets and continually enhance your overall accounts receivable management. To untwine this issue let us see how we can set up the strategic and tactical initiatives for our success.

Strategic Initiatives:

- Understanding Customer Payment Patterns: A fundamental pillar of effective customer collection involves gaining a profound understanding of how your customers behave when it comes to payments. This entails a thorough analysis of their payment history and discerning any discernible patterns. Recognizing these patterns can help you strategize collection efforts better, particularly regarding the various payment levers customers might employ.

- Assessing Customer Satisfaction: Happy customers are more likely to pay their dues promptly. Monitoring and measuring customer satisfaction levels are crucial in predicting timely payments. Satisfied customers become assets to your cash flow. This can be assessed through critical parameters such as purchase frequency, the number of times a customer has made purchases, and the distribution of purchase intervals.

- Understanding Customer Lifecycle Value: Every customer embarks on a unique journey with your business, and acknowledging this lifecycle is essential. The value that each customer contributes over time can vary significantly. Therefore, it’s imperative to treat high-value, long-term customers differently from occasional, low-value ones. Evaluating customer satisfaction and the effort invested in retaining customer loyalty through additional metrics not only scrutinizes customer satisfaction but also provides insights into the return on investment for each customer.

- Building a Comprehensive Customer View: Collating all available data related to your customers to form a 360-degree view is pivotal. This holistic understanding allows you to customize pricing and discount strategies based on a customer’s creditworthiness, payment history, and long-term potential. This view can be constructed through a straightforward logarithmic integration of the three parameters mentioned above, offering a detailed analysis of your customer’s behaviour, satisfaction levels, and your standing in terms of customer satisfaction.

Tactical Measures:

- Implementing a Collection Tracker: The establishment of a collection tracker is a practical and effective step in monitoring outstanding invoices. Salespeople can input reasons for payment delays and the anticipated collection dates into this tracker. The result is a centralized repository of information that provides clarity on the payment status of each invoice.

- Automating Payment Reminder Emails to Customers: Automation can play a pivotal role in maintaining consistent communication with customers regarding overdue payments. Automated reminder emails, which include explicit information about the due amount and payment deadlines, facilitate the timely receipt of payments, eliminating the need for constant manual follow-up.

- Automated Reminders for Sales Employees: Sales personnel may sometimes overlook the task of following up on outstanding dues. Automation provides a solution here as well. By implementing automated reminders for sales employees concerning pending collections, you ensure they remain diligent in fulfilling their responsibilities.

In summary, effective customer collection is a nuanced process that necessitates a two-pronged approach. Strategic initiatives involving the comprehension of customer payment patterns, the assessment of customer satisfaction, and the understanding of customer lifecycle value lay the groundwork for tailored collection strategies.

On the tactical front, implementing tools like a collection tracker and automated reminders streamlines the collection process, reducing errors and expediting payments. BiCXO, our business intelligence solution, amplifies these efforts by providing in-depth insights into customer behaviour, satisfaction, and value.

Balancing strategic insight with tactical efficiency is the key to a successful customer collection process. This approach ensures a healthy financial flow while preserving essential customer relationships. Mastering customer collection is an ongoing journey, and by applying the principles discussed here, you can navigate its challenges effectively and cultivate lasting customer loyalty.

Incorporating BiCXO-like Business Intelligence solution into your collection process equips you with the tools to merge strategic insights with tactical efficiency. This results in a more effective and customer-centric approach to customer collection, all while maintaining a healthy financial flow and preserving vital customer relationships.