Expense analysis is a critical component of financial management, enabling businesses to evaluate their spending patterns, identify inefficiencies, and make informed decisions for improved financial performance. By systematically reviewing and categorizing expenses, organizations can optimize resource allocation and ensure alignment with their strategic goals. This blog explores the fundamentals of expense analysis, its significance for corporate finance teams, and how automation enhances this process.

Content:

- Understanding expense data analysis

- The Role of Corporate Finance Teams

- Importance of Monthly Expense Analysis

- The Role of Automation in Expense Analysis

- Budget vs. Actual Analysis

- Enhancing Departmental Collaboration

- Conclution

Understanding expense data analysis

Expense data analysis involves examining a company’s expenditures to understand where resources are being allocated and how effectively they are being used. This process typically includes categorizing expenses, comparing them against budgets, and identifying areas for cost optimization. It is not limited to simply tracking costs, but extends to interpreting data to make actionable recommendations.

The primary goal of expense analysis is to provide insights that support strategic decision-making. By identifying trends, inefficiencies, or overspending, businesses can adjust their operations to achieve better financial outcomes. Expense analysis is particularly valuable for companies operating in competitive environments, as it helps maintain cost discipline and ensure sustainability.

The role of corporate finance teams

Corporate finance teams play a pivotal role in leveraging expense analysis to improve company performance. They are responsible for collecting, organizing, and interpreting financial data to provide a clear picture of the organization’s expense landscape. The insights generated through expense analysis are used to:

Enhance Cost Efficiency: Finance teams identify cost-saving opportunities by analyzing trends and benchmarking expenses. This may involve renegotiating supplier contracts, optimizing procurement processes, or streamlining operations.

Support Strategic Planning: Expense data analysis provides a foundation for strategic decisions, such as entering new markets, launching new products, or restructuring operations. By understanding expense patterns, finance teams can assess the financial feasibility of such initiatives.

Monitor Financial Health: Regular expense analysis ensures that spending aligns with the company’s financial objectives. This helps prevent budget overruns, maintain profitability, and ensure sufficient cash flow.

Evaluate Departmental Performance: By comparing actual expenses against budgets for each department, finance teams can identify variances and address discrepancies promptly. This fosters accountability and encourages departments to adhere to financial plans.

Importance of monthly expense analysis

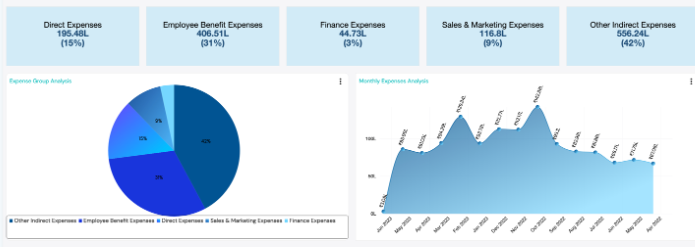

Conducting expense data analysis on a monthly basis is crucial for maintaining financial discipline and agility. Monthly reviews provide timely insights, allowing businesses to adapt quickly to changing circumstances. The benefits of regular expense analysis include:

Proactive Issue Identification: Monthly analysis helps detect irregularities, overspending, or inefficiencies early, minimizing potential financial risks.

Improved Budget Accuracy: Frequent reviews enable more accurate budget forecasting by incorporating the latest expense trends and patterns.

Enhanced Decision-Making: Access to up-to-date financial data empowers management to make informed decisions and respond promptly to emerging challenges or opportunities.

Consistency in Performance Tracking: Monthly analysis ensures that financial performance is monitored consistently, providing a reliable basis for evaluating progress toward organizational goals.

The role of automation in expense analysis

Automation has revolutionized expense data analysis by streamlining data collection, processing, and reporting. Automated tools and software solutions significantly reduce the manual effort involved in managing expenses, improving accuracy and efficiency. Key advantages of automation include:

Real-Time Expense Tracking: Automated systems enable businesses to track expenses in real time, providing immediate visibility into spending patterns. This allows for prompt corrective actions when necessary.

Trend Analysis: Automation facilitates the identification of trends and anomalies by analyzing large volumes of data quickly and accurately. This helps businesses uncover insights that may not be apparent through manual analysis.

Integration with Financial Systems: Many automated tools integrate seamlessly with accounting and enterprise resource planning (ERP) systems, ensuring that expense data is updated and consolidated automatically.

Customizable Reporting: Automated solutions offer customizable reporting features, enabling businesses to generate tailored reports that meet specific requirements. This ensures that relevant insights are available to decision-makers.

Budget vs. Actual analysis

One of the most critical applications of expense analysis is the comparison of budgeted versus actual expenditures. This analysis helps organizations assess whether they are adhering to financial plans and identify variances that require attention. In a corporate setup, budget vs. actual analysis involves:

- Establishing Parameters: Finance teams define parameters such as departmental budgets, project allocations, and cost categories. These parameters serve as benchmarks for comparison.

- Analysing Variances: By comparing actual expenses against budgeted figures, teams can identify variances and investigate their causes. Positive variances indicate cost savings, while negative variances signal overspending or inefficiencies.

- Providing Insights: Variance analysis highlights areas where corrective actions are needed, such as revising budgets, reallocating resources, or addressing inefficiencies.

Automated tools enhance this process by consolidating data from various sources, generating variance reports, and providing actionable insights. They also allow for scenario analysis, helping businesses evaluate the impact of potential changes on their financial outcomes.

Enhancing departmental collaboration

In a corporate environment, expense analysis involves multiple departments, each with unique budgets and spending patterns. Automation facilitates collaboration by providing a centralized platform for tracking and analyzing expenses across the organization. Key features include:

- Department-Specific Dashboards: Automated tools offer department-specific dashboards that provide visibility into individual budgets, expenses, and variances. This encourages accountability and fosters a culture of transparency.

- Consolidated Reporting: By aggregating data from all departments, automation ensures that finance teams have a holistic view of the organization’s expenses. This supports comprehensive analysis and strategic planning.

- Predictive Insights: Advanced tools leverage machine learning algorithms to predict future expense trends based on historical data. These insights help departments plan more effectively and align their budgets with organizational goals.

Expense data analysis is an indispensable practice for businesses seeking to optimize their financial performance. By providing insights into spending patterns, it enables organizations to identify inefficiencies, control costs, and make informed decisions. Monthly expense analysis ensures consistent monitoring, timely issue resolution, and improved budget accuracy.

In today’s dynamic business environment, leveraging expense data analysis and automation is essential for maintaining competitiveness and ensuring long-term financial sustainability. Organizations that prioritize these practices are better equipped to navigate challenges, seize opportunities, and achieve their goals efficiently.