Introduction to Treasury Management

Treasury management refers to the method of handling cash, liquidity and financial risk. It would comprise tracking of cash flows, fund allocation, management of bank relationships and monitoring of risk exposures. Treasury management system would provide real-time data access, enhance the accuracy of reports and enable regulatory compliance. Properly structured, treasury management would facilitate business continuity and financial stability.

Current Trends in Treasury Management

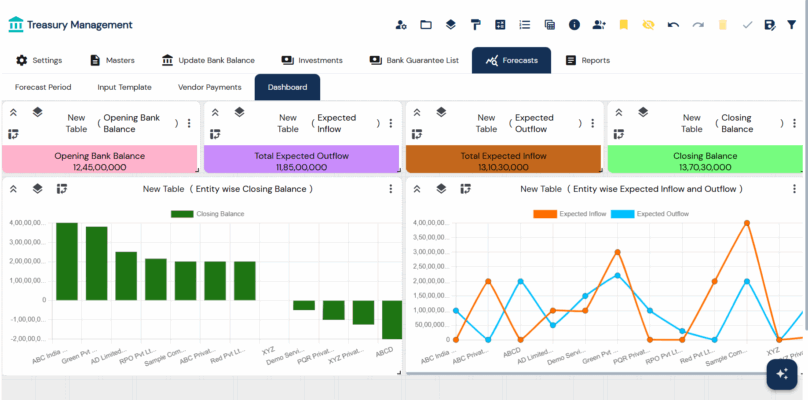

Technology is currently at the core of treasury operations. Digital solutions are employed for transaction processing, cash visibility and reconciliation. Automated platforms such as treasury management solutions are employed to manage day-to-day tasks and minimize the use of manual efforts. Treasury dashboards are employed to display balances, forecasts and payment flows on all accounts.

Cloud platforms today, are complemented by remote access to treasury systems and data. Security protocols ensure protection of sensitive data and ensure compliance. APIs are permitted direct interaction between platforms with the assistance of bank connectivity hence minimizing delays and errors.

Integration of data across enterprise systems, such as ERP and accounting software, would enable businesses to have centralized control. Reporting consolidated will ensure businesses improved visibility into financial health. Adherence to global regulations would remain the driving force behind treasury activities, with emphasis on transparency and risk management.

The Future of Treasury Management: Trends to Watch in 2025 and Beyond

In the next few years, treasury management solutions will further move towards real-time information, digital money and strategic alignment with business planning. Some trends will impact treasury functions around the world:

1. AI and Predictive Analytics

Artificial intelligence will help with forecasting and anomaly detection. Treasury groups will leverage these technologies to analyse cash flow patterns, identify potential risk and enhance precision in decision-making. Predictive models will inform funding, investment and liquidity plans.

2. Real-Time Treasury

Treasury operations will migrate toward real-time information. Continuous data feeds will facilitate cash monitoring, position monitoring and payment approval. This move will enhance responsiveness and decrease lag in financial decision cycles.

3. Open Banking and API Integration

APIs will enhance banking and corporate system relationships. Treasury teams will have access to current bank information, automate reconciliations and enable quicker settlements. This integration will facilitate straight-through processing and minimize manual inputs.

4. Digital and Central Bank Digital Currencies (CBDCs)

Cryptocurrencies will start to impact payment systems. Central bank digital currencies can be included in treasury transactions. Tokenized assets will increase settlement choices and offer alternatives to fiat currency.

5. ESG and Responsible Finance

ESG considerations will shape treasury policies. Investment approaches will take sustainability objectives and ethical considerations into account. Treasury groups will integrate financial planning with business values and long-term social objectives.

6. Risk Management and Scenario Planning

Sophisticated risk models will facilitate interest rate exposure, currency volatility, and counterparty risk assessment. Scenario planning will facilitate planning for external shocks and maintaining liquidity under varying conditions. Treasury systems will enable stress testing and risk simulation.

7. Treasury as a Strategic Function

Treasury departments will collaborate extensively with top leadership to facilitate capital structure, planning for growth, and international expansion. The treasury function will expand beyond cash management to encompass funding choices, allocation of resources, and business forecasting.

Conclusion

Treasury management solutions will be moving into a new era. With the emergence of AI, real-time data, digital money and ESG-driven finance, treasury operations will be changing. Teams will have to change, develop digital skills and concentrate on strategic outcomes. The future of treasury management is linked, data-driven and in alignment with overall business objectives.

Artificial intelligence would be driving treasury management even more in the future. As treasury management continues to evolve, AI will become a revolutionary force that empowers predictive analytics for precise forecasting, automates risk management, and improves fraud detection. It enables informed investment decisions with real-time analysis of data, automates mundane processes through automation, and allows for dynamic scenario modelling in order to be better prepared. Natural Language Processing can make data access easier with the use of intelligent assistants, and AI aids in bringing ESG considerations into financial planning. Overall, AI enables treasury teams to be more strategic, responsive, and aligned with wider business objectives