What if there were no map and compass and a sailor has to cross the foggy waterways? Tricky, right? Now, let’s shift that scenario to the world of finance. Navigating the vast sea of financial decisions without clear visibility can be equally daunting. But, for KPI dashboards revolutionize the way these decisions are made! With the power of data visualization and performance metrics, KPI dashboards offer a lifeline, transforming complex data into actionable insights. Let’s get started to dive into the world of KPI dashboards.

Importance of KPI Dashboards in Financial Decision-Making

Financial decision-making has changed significantly since the spread of technology, notably with the introduction of KPI (Key Performance Indicator) dashboards. These tools have transformed how companies perceive, evaluate, and act on financial data, resulting in a more dynamic and effective approach to managing financial health and performance.

Definition and Purpose of KPI Dashboards

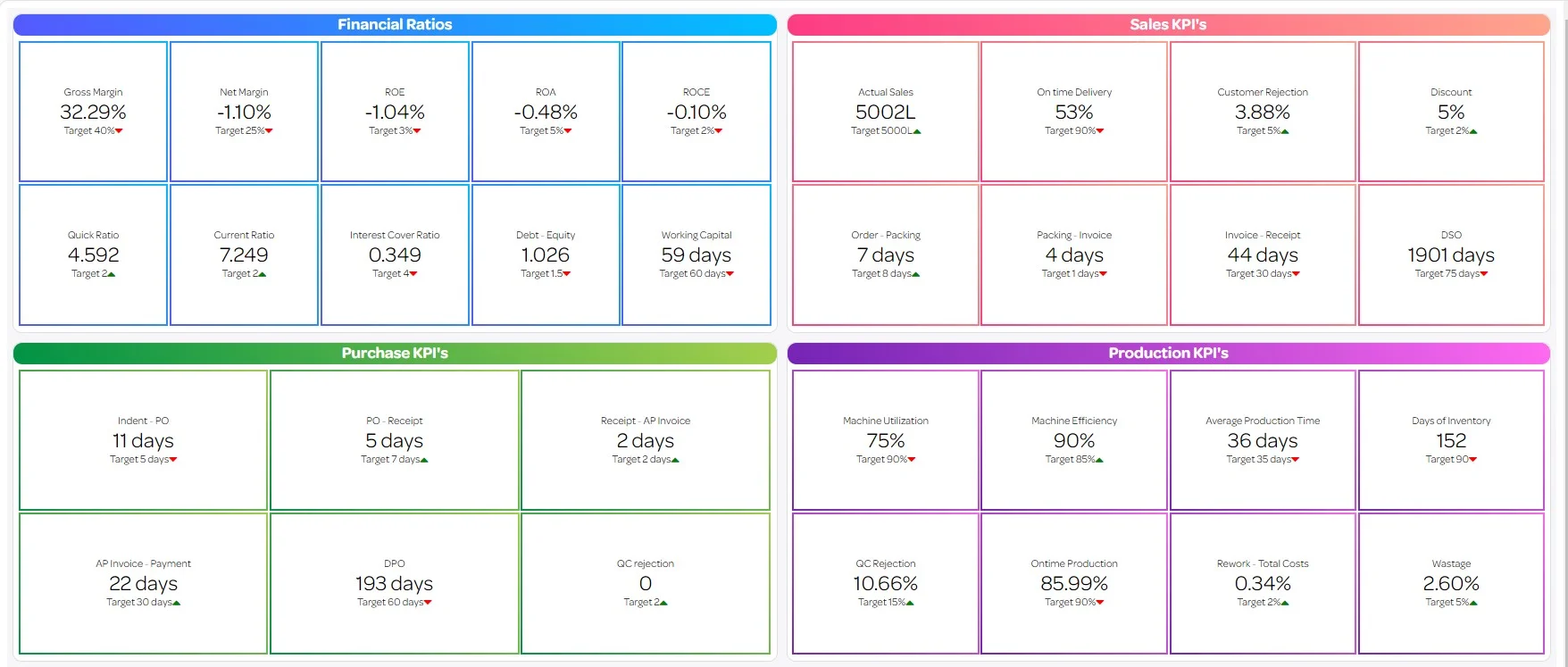

KPI Dashboards are interactive tools that present a company’s key performance indicators in a visual format, providing an overview of its current performance in respect to its financial objectives. A KPI dashboard serves multiple purposes. It simplifies complex data sets, letting users to view and analyze organizational performance at a glance. These dashboards include a variety of financial measures such as sales, profit margins, expenses, and more, allowing decision-makers to easily examine and respond to the business’s financial situation and trends.

KPI Dashboards benefits when used for Financial Insights

The benefits of employing KPI dashboards in financial decision-making are numerous and varied. For beginnings, they deliver real-time analytics, allowing companies to make quick and informed choices. Furthermore, they aid in spotting trends and patterns in financial performance that may not be obvious using typical reporting methods. This can result in the discovery of new development prospects or the early identification of potential financial risks. But have you ever considered what will happen next? We have real-time analytics, charts, and trends, but KPI dashboards ensure that financial leaders make data-driven decisions, rather than relying on intuition.

Data Visualization Through KPI Dashboards

The power of KPI dashboards lies not just in the data they compile, but in how they present this data. Data visualization is a key aspect of KPI dashboards, making complex information accessible and understandable at a glance.

Importance of Visual Representation in Financial Data Analysis

Financial data analysis relies heavily on visual representations. Human brains digest visual information much faster than text or numbers, so insights can be gained almost quickly from a well-designed chart or graph. This quick comprehension enables rapid analysis, which is critical in a fast-paced commercial world. Visuals also help to communicate complex financial information across teams and to stakeholders, ensuring that everyone understands the organization’s financial health and direction.

Key Performance Metrics for Financial Decision-Making

When making financial decisions, it is critical to have access to and understand key performance measurements (KPIs). These measures not only provide an overview of a company’s current financial situation, but also forecast future financial performance. Let’s look at some of the key financial KPIs that every organization should track.

Revenue and Profit Metrics

Revenue and profit metrics are at the heart of financial decision-making. They provide insight into the company’s overall financial performance and growth potential. Some of the key metrics include:

– Net Profit Margin: This measures how much net income a company generates as a percentage of its revenue. It’s a clear indicator of the company’s profitability and operational efficiency.

– Gross Profit Margin: By highlighting the percentage of revenue exceeding the cost of goods sold, this metric sheds light on the profitability of a company’s core activities.

– Annual Recurring Revenue (ARR) and Monthly Recurring Revenue (MRR): Especially important for businesses with subscription models, these metrics help in understanding the predictable and recurring revenue generated over time.

Cash Flow Metrics

Cash flow metrics are essential for assessing the liquidity and operational efficiency of a company. They include:

– Operating Cash Flow (OCF): Reflecting the cash generated from regular operational activities, this metric indicates whether a company is capable of maintaining and growing its operations.

– Free Cash Flow (FCF): It measures the cash a company generates after accounting for capital expenditures. This metric is crucial for investors, as it shows the company’s ability to repay debt, pay dividends, and facilitate growth.

– Cash Conversion Cycle (CCC): This provides insight into the efficiency of a company’s sales and inventory processes and its ability to manage payable accounts effectively.

ROI and ROE Metrics

Return on Investment (ROI) and Return on Equity (ROE) are critical metrics for evaluating the profitability and efficiency of financial resources.

– ROI: This measures the gain or loss generated on an investment relative to the amount of money invested. It’s a versatile metric used to compare the efficiency of several investments.

– ROE: ROE assesses a company’s ability to generate income from its equity investments. High ROE values indicate effective management and a potentially profitable investment for shareholders.

Case Studies: Successful Integration of KPI Dashboards

Real-life Application of KPI Dashboards for Improved Performance

Next, let’s dive into the journey of a MNC that leverages KPI dashboards to steer through the competitive landscape. This MNC utilizes a custom-designed KPI dashboard that tracks crucial financial metrics such as cash flow, burn rate, and revenue growth alongside key performance indicators like user acquisition cost and lifetime value. This holistic approach provided with a 360-degree view of their financial standing and operational efficiency, allowing them to quickly pivot strategies, enhance investor relations, and improve financial forecasting. By making data-driven decisions grounded in their KPI dashboard, this MNC has not only survived but thrived, doubling their revenue while maintaining lean operations.

Best Practices for Using KPI Dashboards in Financial Decision-Making

Setting Clear Objectives and Metrics

The first step is to identify clear goals. Whether you need to boost sales, reduce costs, or enhance cash flow, aligning KPIs will provide financial decision makers with valuable insights.

Ensuring Data Accuracy and Integrity

The accuracy and integrity of the underlying data are critical to the success of any KPI dashboard. It is critical to create rigorous data validation methods to guarantee that the data entering into your dashboard is accurate, up to date, and complete. Remember that the insights obtained from your KPI dashboard are only as good as the data that supports them.

Regular Monitoring and Evaluation of KPIs

Finally, the real significance of KPI dashboards in financial decision-making originates from regular monitoring and constant evaluation. This is not simply looking at your dashboard every now and again, but actively using it to track progress toward your financial goals, identify trends, and uncover anomalies.

Additionally, it’s vital to remain flexible and adapt your KPIs as your business evolves – what was crucial six months ago might not be relevant today. This dynamic approach ensures that your financial decisions always rest on the most pertinent and up-to-date information available.

Future Trends in KPI Dashboards for Financial Decision-Making

The world of finance is evolving rapidly, and KPI dashboards are at forefront of this shift, enabling better, faster financial decisions. As we look ahead, two trends stand out: predictive analytics and forecasting, and the integration of artificial intelligence and machine learning. These innovations have the potential to further transform the use of data in developing financial strategies.

Predictive Analytics and Forecasting

Imagine if you could look into a crystal ball and see the future of your finances. Well, predictive analytics and forecasting are the next best thing! These powerful tools enable businesses to make informed predictions about future trends based on historical data.

– Predictive analytics sifts through vast amounts of data to identify patterns, helping financial experts anticipate market shifts or customer behavior changes.

– Forecasting, on the other hand, uses this data to make concrete predictions about future conditions, such as sales forecasts or budget requirements.

By integrating these capabilities into KPI dashboards, businesses can not only track their current financial health but also make proactive decisions that steer them towards a more profitable future.

Artificial Intelligence and Machine Learning Integration

Artificial Intelligence (AI) and Machine Learning (ML) are set to redefine KPI dashboards, making them not just interactive, but intelligent.

– AI can help in automating complex data analysis processes, providing insights that would take humans much longer to derive.

– Machine Learning improves over time, learning from past decisions and outcomes to provide increasingly accurate predictions and recommendations.

This synergy between AI, ML, and KPI dashboards means financial decision-making can evolve from reactive to strategic, leveraging data in ways previously unimaginable. The dashboard of the future won’t just tell you where your business stands; it will recommend where to go next and anticipate the financial landscapes you’re yet to navigate.

Conclusion

The advent of KPI dashboards marks a revolutionary leap in financial decision-making. By integrating data visualization and performance metrics, these powerful tools transform complex financial data into clear, actionable insights. No longer do business leaders need to navigate through seas of spreadsheets or reports. Instead, they are empowered with real-time, accessible, and visually compelling information that guides strategic planning, monitors progress, and drives success.

– KPI dashboards make data accessible and understandable for all, ensuring that decisions are made on a solid foundation.

– They bring a new level of efficiency, allowing businesses to respond quickly to market changes and internal performance shifts.

– By focusing on key performance indicators, companies can align their efforts with their strategic goals, making every decision count towards their overarching objectives.

In conclusion, the importance of KPI dashboards in the realm of financial decision-making cannot be overstated. They not only illuminate the path toward greater profitability and business growth but also democratize data, allowing everyone within an organization to participate in its success. As we move forward, the integration of KPI dashboards will undoubtedly continue to be a key driver in the evolution of business strategy, making them an indispensable tool in the arsenal of modern business leaders.